- Home

- About

- Services

- Banking App Development

- Insurance Software Development

- Crowdfunding Platform Development

- Finops Services

- Digital Wallet Development

- Decentralized Finance (DeFi) Platform

- Resource Augmentation

- Currency Exchange Platform Development

- Integration Services

- Cybersecurity

- Products

- Contact

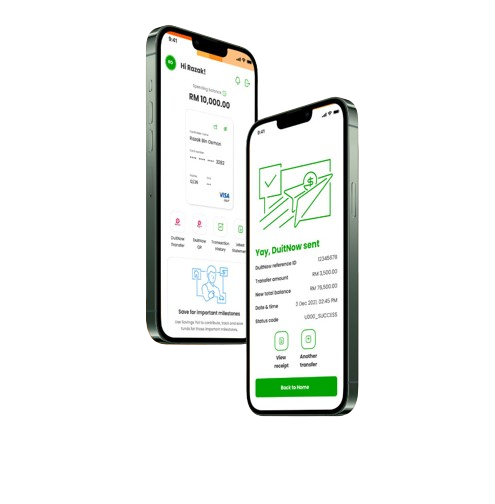

TRANSFORMING BANKING WITH AL RAJHI BANKING & INVESTMENT CORPORATION (MALAYSIA)

Experience a new era in banking with Rize. Open a savings account anytime, anywhere, apply for personal financing with funds deposited in your account within 15 minutes. Rize provides 24/7 access to your financial information and a comprehensive suite of banking services. Whether you want to check your balance, transfer funds, pay bills, or deposit checks, it’s all convenient and secure from the comfort of your home or on the go using Rize.

Rize is revolutionizing the banking experience, combining anytime, anywhere access, robust security measures, personalized financial insights, and a wide range of banking services. Embrace the power of digital banking with Rize and unlock a world of possibilities for effortless and efficient financial management.

Current Features

ACCOUNT MANAGEMENT:

Users can access and manage their bank accounts, check balances, view transaction history, and perform various banking activities directly from their mobile devices.

PAYMENTS AND TRANSFERS:

The app allows users to make local and international transfers, pay bills, and conduct other financial transactions seamlessly.

BUDGETING AND EXPENSE TRACKING:

It offers tools to help users track their expenses, set budgets, and manage their finances more effectively.

CUSTOMER SUPPORT:

This app incorporates customer support features to provide assistance and resolve queries directly through the app.

SECURITY FEATURES:

Security is a top priority for banking apps. Rize likely implements robust security measures, such as encryption and authentication methods, to ensure the safety of users' financial information.

Essential Banking Services

READY CASHLINE (RCL)

Credit Line:

- The bank assigns a maximum credit limit to its customers which they can use for various financial needs.

- Monitoring of utilized limits.

Encouraging Financial Behavior:

- Introducing Cashback incentive

Flexibility and Adaptability:

- Interest is only charged on the outstanding balance, and it’s typically based on the amount of credit utilized.

- The customer can make regular payments to repay the borrowed amount.

- As the customer repays the borrowed amount, the credit limit becomes available again.

Technology Integration:

- RCL origination facilitated via Digibank app.

- Access to generated RCL reports via portal for compliance and management.

TERM DEPOSIT (TD)

Investment:

- Term Deposit is a lump sum savings account with a fixed deposit period.

- Seamless digital investment.

Encouraging Digital Investment:

- Introducing Digital Term Deposit placements via App.

Flexibility and Adaptability:

- Predetermined interest rate which remains constant throughout the deposit period.

- Aims to improve digital banking experience.

- Prioritize capital preservation and a predictable income stream.

- Earn interest at the end of the deposit term

Technology Integration:

- TD origination is facilitated through the Digibank app.

- Access to generate TD reports via the portal for portfolio management and compliance.

Digital Lending

Personal Financing (PF)

Personal Credit:

- Amount approves depending on to customer’s financial profile and may have a fixed limit.

- Get funds to achieve your personal financial needs.

Encouraging Digital Lending:

- Introducing fixed term financing

Flexibility and Adaptability:

- Financing that comes with an interest rate that is fixed.

- Customer repay the loan in installments over a fixed period, with options for short or long-term loans.

- With minimal documentation, approval for the loan can be obtained.

Technology Integration:

- PF origination facilitated via Digibank app.

- Access to generated PF reports via portal for compliance and management

Corporate Financing (CF)

SME Financing:

- Specialized financing and credit options for your large-scale projects for business expansion

- Get funds to achieve your Business goals

Encouraging Digital Financing:

- Introducing Digital SME Financing

Flexibility and Adaptability:

- Financing that comes with fixed repayment terms.

- Customers repay the loan in installments over a fixed period, for long-term loans.

- Offer digital platforms for SMEs to manage their finances, make transactions, and access funding more efficiently.

Technology Integration:

- CF origination is facilitated through Digibank app.

- Access to generate CF reports via the portal for portfolio management and compliance.

Let's Transform Your Business Today!

Ready to harness the power of digital wallets and revolutionize the way you do business? Contact us today to discuss your digital wallet development needs. Together, we’ll create a tailored solution that propels your business forward in the digital age.

0

+

Powered Merchant

0

+

Trusted Partner

0

+

Professional Team

0

%